Short-Term Finance: A Complete Guide for Beginners

Managing money effectively is crucial for every business. Whether you’re running a small startup, a medium-sized company, or even handling personal finances, there will be times when you need extra funds to cover immediate expenses. This is where short-term finance becomes essential.

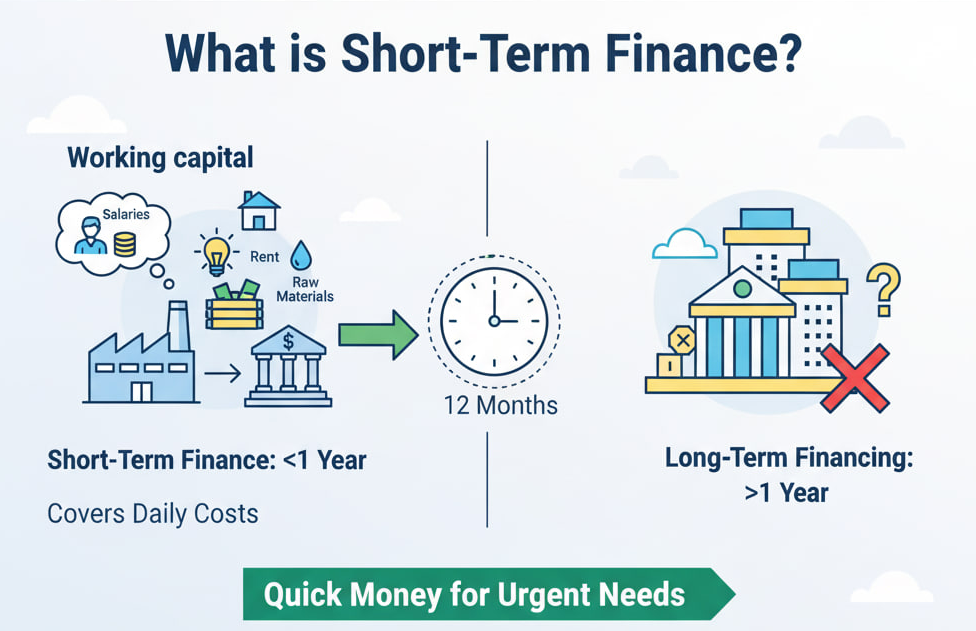

What is Short-Term Finance?

Short-term finance refers to money borrowed or arranged for less than one year. It mainly covers working capital needs and daily operating costs such as salaries, rent, utilities, and raw materials.

Unlike long-term financing, which supports big investments like property or machinery, this type of funding ensures businesses have enough cash to keep running smoothly.

👉 In simple words, it’s quick money to manage urgent financial needs, repayable within 12 months.

Main Features You Should Know

The key characteristics of short-term funding include:

- Duration: Must be repaid within 12 months.

- Purpose: Covers immediate business needs.

- Sources: Trade credit, overdrafts, factoring, and short-term loans.

- Flexibility: Easier to arrange compared to long-term finance.

Common Sources of Short-Term Finance

Businesses and individuals can access temporary funding through several options:

- Bank Overdraft – Borrow more than your account balance to cover urgent expenses.

- Trade Credit – Get goods or services now and pay later (usually 30–90 days).

- Factoring – Sell unpaid invoices to a finance company for instant cash.

- Short-Term Loans – Quick loans from banks or financial institutions repayable within a year.

- Commercial Paper – Unsecured notes issued by large, creditworthy companies.

Pros and Cons

Advantages

- Provides fast access to cash.

- Keeps daily operations running smoothly.

- Helps cover unexpected expenses.

- Requires less paperwork compared to long-term loans.

Disadvantages

- Higher interest rates compared to long-term financing.

- Frequent repayments may strain cash flow.

- Not suitable for large-scale or long-term projects.

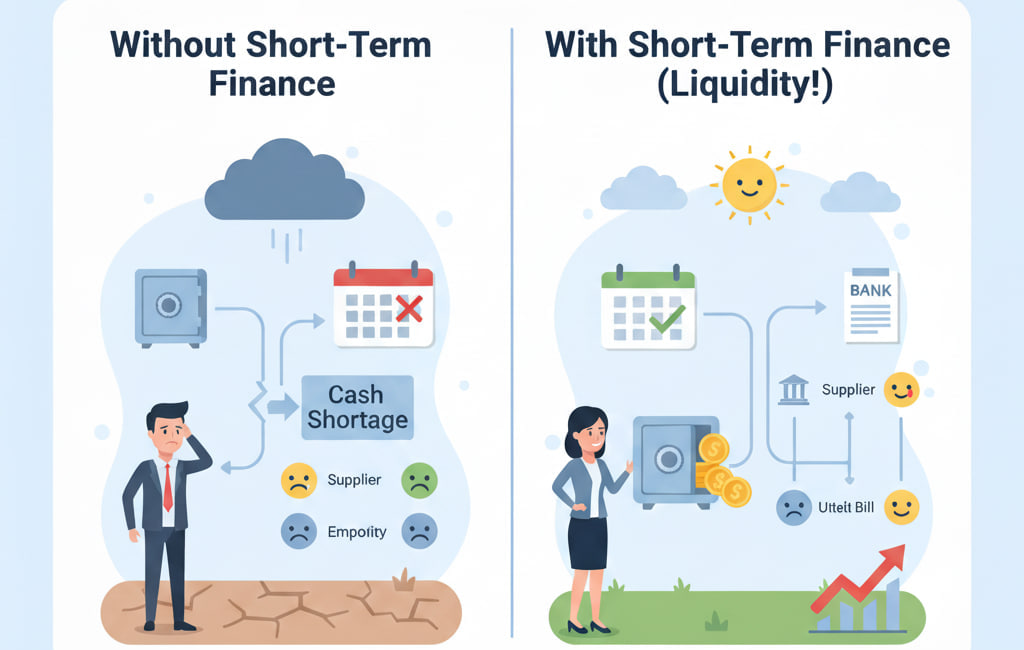

Why It Matters for Businesses

Short-term finance is vital for maintaining liquidity. Without it, companies may struggle to pay suppliers, employees, or bills. When used wisely, this type of funding prevents cash shortages and keeps operations stable.

Final Thoughts

So, what is short-term finance? It’s a financial tool that provides quick access to funds for urgent needs. Managed responsibly, it helps businesses maintain a healthy cash flow and support day-to-day operations effectively.